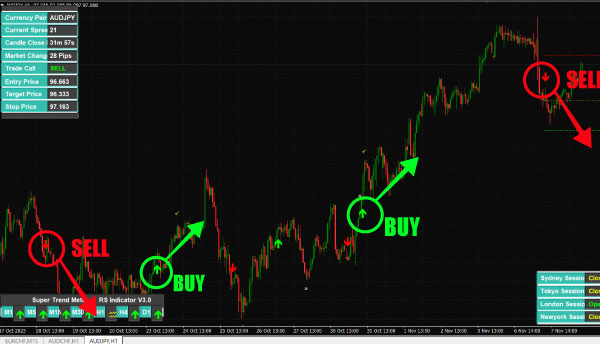

Welcome to the future of Forex trading! Introducing the Non-Repaint Reversal Scalping Indicator for MT4 – your ultimate tool for unlocking precision entries and maximizing profits. This cutting-edge indicator is designed to revolutionize your trading strategy, providing unparalleled accuracy in identifying trend reversals and capturing profitable opportunities.

Key Features:

- Non-Repaint Technology: Say goodbye to false signals and unreliable indicators. Our Reversal Scalping Indicator employs advanced non-repaint technology, ensuring that you receive accurate signals in real-time.

- Precision Entries: Gain a competitive edge with precise entry points that allow you to enter and exit trades at the optimal moment. Maximize your potential profits with confidence.

- Scalping Efficiency: Perfect for scalpers, this indicator is tailored to the fast-paced world of scalping. Capture quick profits with ease, thanks to the indicator’s responsiveness and effectiveness in volatile market conditions.

- User-Friendly Interface: Designed for traders of all levels, our indicator comes with a user-friendly interface, making it easy to integrate into your MT4 platform. No complex setups or confusing configurations – just install and start trading.

- Customizable Alerts: Receive timely notifications for potential reversals, so you never miss a trading opportunity. Customize alerts to suit your preferences and trading style.

How to Use:

- Install the Non-Repaint Reversal Scalping Indicator on your MT4 platform.

- Follow the clear and actionable signals generated by the indicator.

- Combine with your favorite trading strategies for enhanced results.

Risk Management:

While the indicator provides powerful signals, it’s essential to implement sound risk management practices. Set appropriate stop-loss and take-profit levels to protect your capital and optimize your risk-reward ratio.

Disclaimer:

Trading involves risk, and past performance is not indicative of future results. The Non-Repaint Reversal Scalping Indicator is a tool to assist in your trading decisions but does not guarantee success. Always conduct thorough analysis and consider risk management principles.