Description

The Quasimodo Pattern QM Indicator brings a new level of precision to price action trading. This innovative tool excels at spotting unique reversal patterns, especially after an uptrend. Its ability to deliver high win-rate setups and actionable market insights empowers traders to unlock greater potential in their trading strategies.

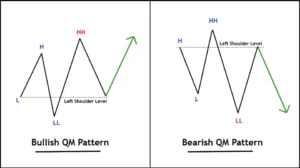

The Quasimodo pattern is a reversal trading formation seen at the end of an uptrend, characterized by three peaks and two valleys, with the middle peak being the highest and the outer two peaks of equal height. Known for its high win rate, this rare pattern can be better identified by running the indicator on a VPS with notifications enabled to capture more signals.

Review and Backtest

Key Features

- Advanced Price Action Analysis Tool

This indicator is designed to detect the Quasimodo Pattern (QM) on MT4 charts, providing traders with opportunities without the hassle of manual charting.

- Try the Demo Version

Get hands-on experience with this tool by downloading the demo version from the product catalog. While the demo displays historical patterns, it serves as an excellent way to explore the indicator’s functionality.

- A Rare but Powerful Market Pattern

Quasimodo patterns don’t occur often, but their high accuracy makes them an essential tool for traders. For optimal performance, it is recommended to run the indicator on a VPS with notifications turned on to capture more signals.

- Reliable with High Accuracy

Thanks to the pattern’s precision, traders can expect a high success rate when using it for reversal trading strategies.

- Instant Market Alerts

Never miss a market move with real-time push notifications sent directly to your mobile device.

Why Choose Quasimodo Pattern QM

User-Friendly: Makes spotting intricate price patterns effortless.

Automated Detection: Continuously scans charts to identify Quasimodo patterns without manual effort.

High-Profit Potential: Delivers a strong win rate with well-defined risk-to-reward strategies.

Practice Mode: Offers a demo version for traders to refine their skills before transitioning to live trading.

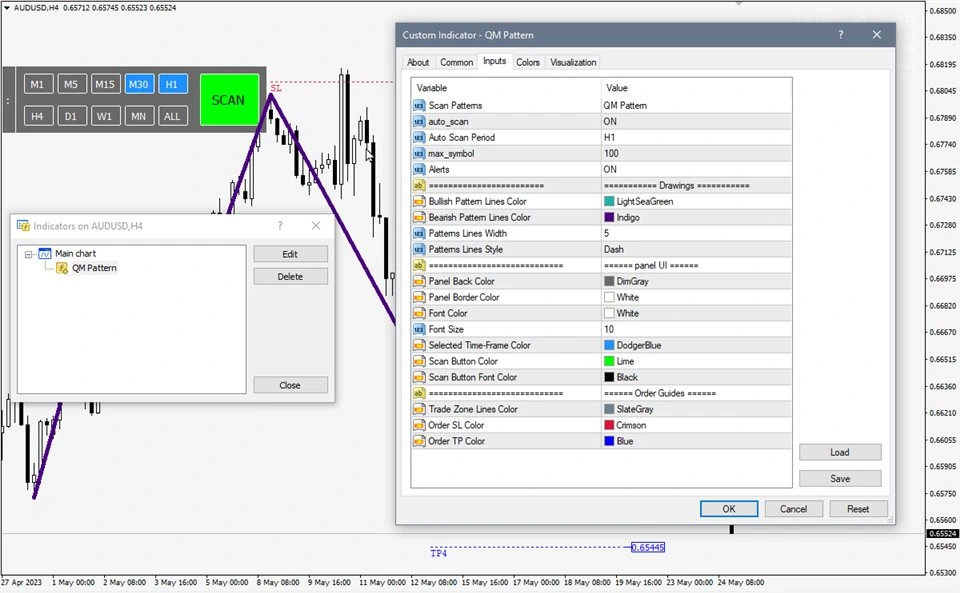

Quasimodo Pattern (QM) MT4 Settings

1. Inputs Section:

- Scan Patterns: QM Pattern – Configured to detect Quasimodo (QM) patterns exclusively.

- auto_scan: ON – Enables automated pattern scanning.

- Auto Scan Period: H1 – Automatically scans patterns on the hourly chart (H1).

- max_symbol: 100 – Scans up to 100 symbols or assets for patterns.

- Alerts: ON – Activates alerts whenever a Quasimodo pattern is identified.

- Push Notification: ON – Sends notifications directly to connected devices.

- Send Email: OFF – Email alerts are turned off.

- Email Subject Text: QM Pattern Signal Detected – Custom subject line for email alerts if enabled.

2. Colors Section (Drawings):

- Bullish Pattern Lines Color: RoyalBlue – Represents bullish QM patterns.

- Bearish Pattern Lines Color: Magenta – Indicates bearish QM patterns.

- Patterns Lines Width: 3 – Sets the line thickness for pattern drawings.

- Patterns Lines Style: Dash – Displays dashed lines for pattern visuals.

3. Panel UI Settings:

- Panel Back Color: DimGray – Sets the background color of the control panel.

- Panel Border Color: White – Outlines the panel in white.

- Font Color: White – Text displayed in the panel is white.

- Font Size: 10 – Adjusts text size within the panel.

- Selected Time-Frame Color: DodgerBlue – Highlights the current time frame in DodgerBlue.

- Scan Button Color: Lime – The “Scan” button is displayed in lime green.

- Scan Button Font Color: Black – Text on the “Scan” button is black.

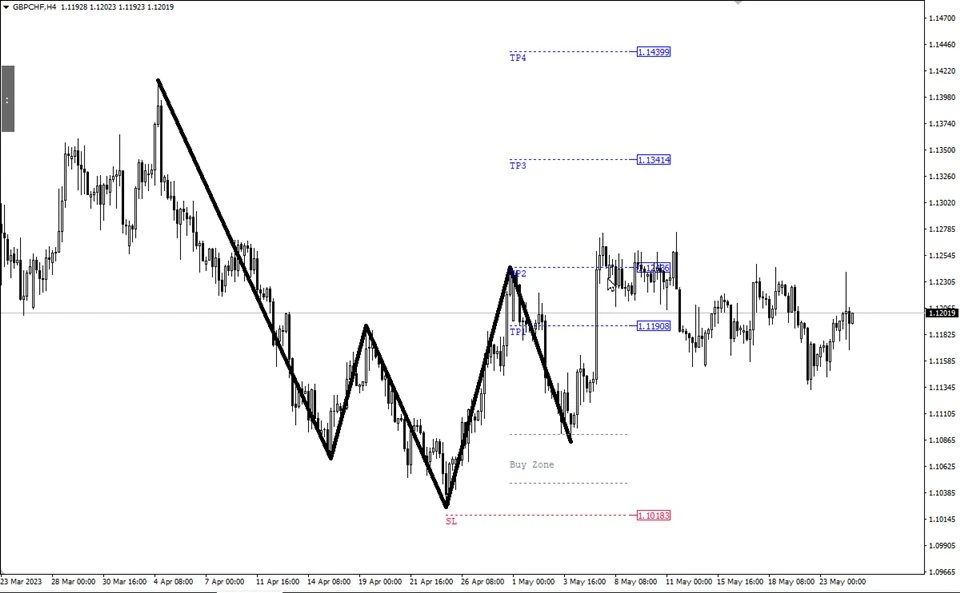

4. Order Guides Settings:

- Trade Zone Lines Color: DarkGray – Marks trade zones with dark gray lines.

- Order SL Color: Magenta – Highlights stop-loss (SL) levels in magenta.

- Order TP Color: DodgerBlue – Displays take-profit (TP) levels in DodgerBlue.

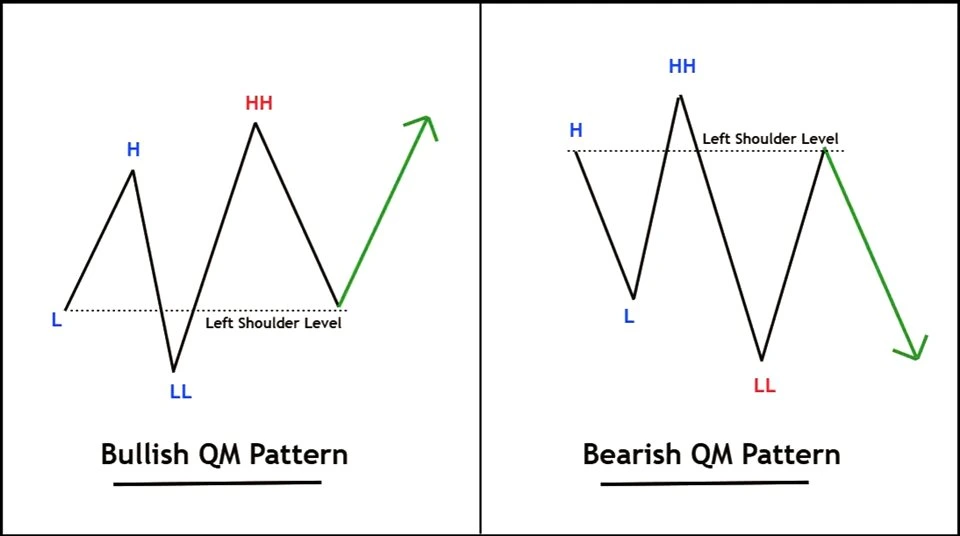

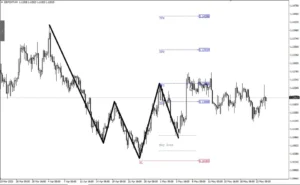

Quasimodo Pattern QM Trading Points

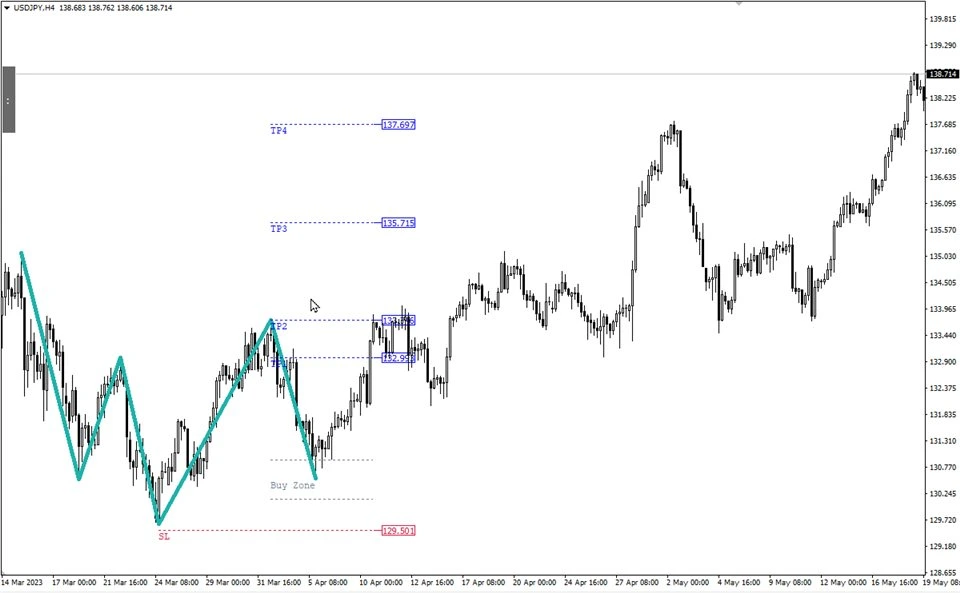

Entry:

As previously mentioned, during a pullback, the price tends to collect unfilled orders, making the left shoulder level a crucial entry point. We wait for the price to return to this level before entering the trade. A smart approach is to incorporate a supply and demand zone at the left shoulder level to refine the entry point further.

Stop Loss:

The stop-loss should be placed just above the higher high in a bearish scenario or below the lower low in a bullish scenario to limit potential losses.

Take Profit:

For a bullish reversal, the take-profit target should be set at the most recent lower low. Conversely, in a bearish reversal, the take-profit target will align with the most recent higher high.

User Reviews

Stay Updated

More Tools – Indicators and Ea’s

Reviews

There are no reviews yet.