Reverse Divergences And Momentum Ebook.

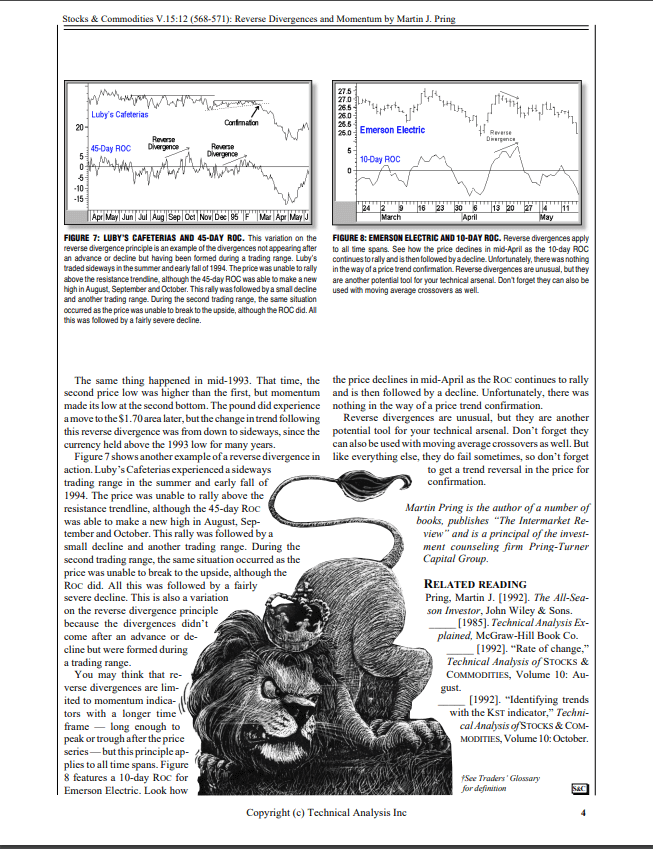

Technical analysts are constantly comparing prices and indicators to see whether they are moving in gear or if there are discrepancies. It’s when discrepancies appear that an alert to a probable change in trend is given. Most traders are familiar with the concept of momentum indicators experiencing positive and negative divergences by Martin J. Pring with the price. For instance, as you can see in Figure 1, momentum makes a series of declining peaks as the price works its way higher. This indicates that the underlying momentum is gradually dissipating, signaling that a peak in the price may be at hand. The opposite set of conditions would be true for a declining trend. The problem with divergences is that you never know how many to expect prior to the actual trend reversal.

An unusual but normally reliable discrepancy occurs when price and momentum switch roles (where the price leads the momentum indicator), the opposite of the normal situation just described.

Profxindicators recommendation is using indicators and EAs with knowledge and experience, then nobody can reverse you. Our main goal is to create expert forex traders and Expert forex traders use their own knowledge, experience with other indicators and resources.

#If you are the copyright owner of any of these e-books and do not want me to share them, please contact us and we will gladly remove them.

Includes:

- NORMAL DIVERGENCE AND PRICE

- REVERSE DIVERGENCE.

- PRICE TREND CONFIRMATION

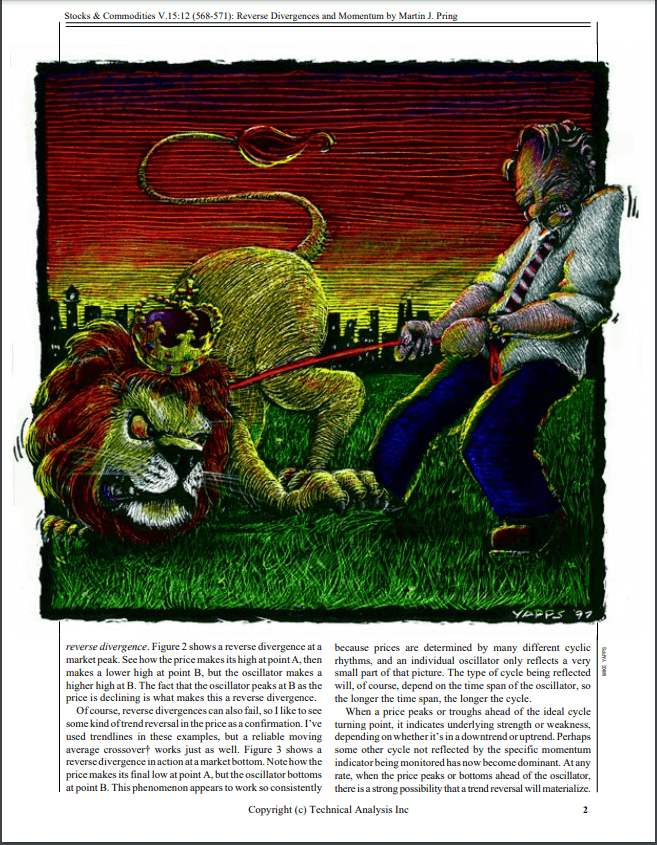

- REVERSE DIVERGENCE IN A TRADING RANGE

- FALLING TO NEW LOWS

- BRITISH POUND AND 39-WEEK ROC

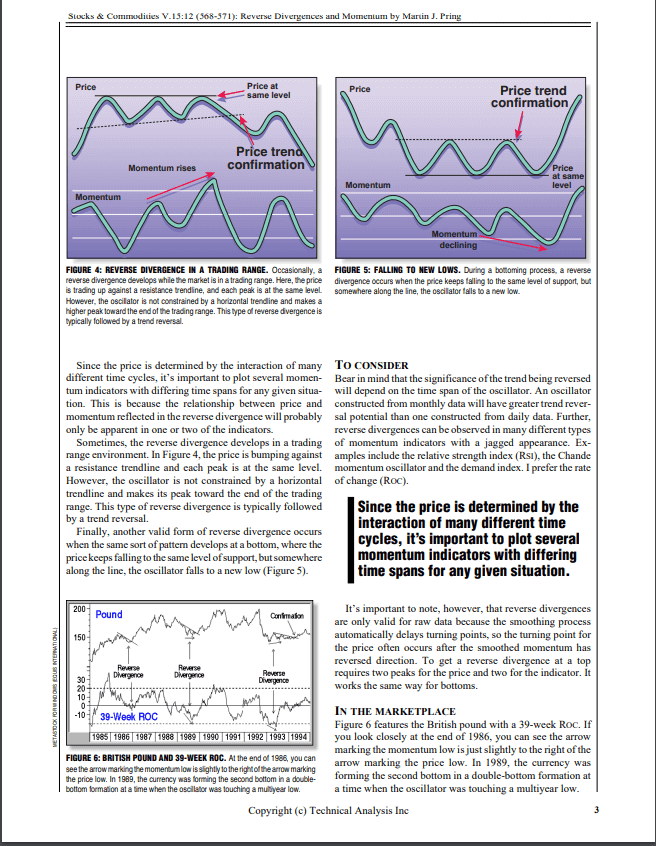

- LUBY’S CAFETERIAS AND 45-DAY ROC

- EMERSON ELECTRIC AND 10-DAY ROC

The books consist of popular and highly profitable trading methodologies used by our most advanced forex traders. You can study them, test them on a demo account first then you can try on a real account.

#credits : by Martin J. Pring